On November 8th Stark Countians passed a sorely needed sales tax of 0.5%.

One of the selling points of Issue 29 by commissioners is the frugality with which they handle county general funds.

As early as today (but it could be next Wednesday), the commissioners will be put to the test on whether or not to raise the contribution of county employees for their share of premium payment for health insurance provided by their respective Stark County departments of government. Their contribution rate currently stands at 10%.

County Benefits Coordinator Carol Hayn (at yesterday's commissioner work session) recommended to commissioners that they maintain the annual premium at $14,580 ($1,215.00 monthly) for a family plan and $5,700 ($475.00 monthly for an individual plan. Indications are that commissioners will follow Hayn's recommendation.

However, Hayn made no recommendation for the employee contribution in terms of an increase or no increase in the 10% contribution rate.

Stark County is a self-insurer on the first $150,000 per year, per claim of heath care costs at which point catastrophic commercial coverage kicks in.

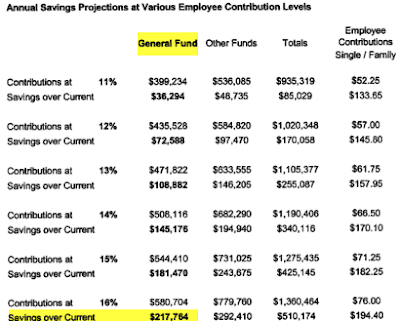

Hayn did provide data upon which the commissioners can ruminate upon in arriving at their decision on the employee contribution rate for 2012 and beyond.

If commissioners were to increase the employee's contribution to 16%, Stark County's general fund would be $217,764 richer.

Some 705 county employees (non-bargaining units only) will be affected by whatever the commissioners decide.

Bargaining units negotiate the employee contribution rate in collective bargaining which stands - on average - at about 6%

Chief Administrator Micheal Hanke said at yesterday's meeting that a goal of county officials is to get the 6% bargaining unit rate up to the non-bargaining employee rate.

The SCPR went out and got some data from the private sector so that readers could have something to compare against in assessing whether commissioners should increase the 10% upwards, and, if so, by how much.

The Kaiser Family Foundation (Kaiser) and the Health Research & Educational Trust (HRET) recently put out a report that is instructive. The following graphic shows that - on average - employees in the private sector pay 27% of there health insurance premium.

Benefits Coordinator Hayn tells the SCPR that she knows of government units which require employees to pay 15% of the premium cost.

Stark County employees have seen a steady rise in their contribution rate since 2007. Prior to 2007 they paid nothing. But in 2007 commissioners imposed a 3% contribution rate followed up by annual increases ever since.

Another factor for commissioners to consider is that county employees have had no pay increase for several years.

So the framework is set up.

Factors militating against an increase:

- no pay raises for several years

- Stark County's bargaining units only pay 6% on average

- five (5) consecutive increase from 0% to 10%

- commissioners duty of frugality to Stark County taxpayers

- Stark County employees below other government workers in contribution rate who pay as high as 15%

- Stark County employees dramatically below what private sector workers pay (average about 27%)

Moreover, you can weigh-in. Undoubtedly, they would be delighted to hear from you. Here is contact information for your Stark County commissioners:

No comments:

Post a Comment